The Economy Is Doing So Good We Haft to Lower Intrest Rates Again ?

Monetary Policy Objectives

Banking company Indonesia is mandated with creating and maintaining rupiah stability. That mandate is explicitly stipulated in Act No. 23 of 1999 concerning Bank Republic of indonesia, as amended by Act No. 3 of 2004 and Deed No. vi of 2009 in Article 7. Rupiah stability encompasses two dimensions. Outset, rupiah stability is the price stability of goods and services, as reflected by inflation. The second dimension relates to rupiah exchange charge per unit stability against other currencies. Indonesia implements a complimentary-floating substitution rate regime and commutation rate stability is necessary to reach and maintain cost and financial system stability.

In pursuit of its mandate, Bank Indonesia adopted the Inflation Targeting Framework (ITF) equally its budgetary policy framework on 1st July 2005. ITF is relevant for the mandate and institutional arrangements mandated in prevailing laws. Based on ITF, inflation is the overriding objective. Nonetheless, Bank Indonesia continues to refine its budgetary policy framework based on the changing dynamics and economic challenges faced in order to increase effectiveness.

Monetary Policy Framework

In the implementation of budgetary policy, Bank Indonesia applies an Inflation Targeting Framework (ITF). ITF is a framework of publicly announcing an inflation target corridor and adjusting monetary policy to achieve that target as part of the delivery and accountability of the central depository financial institution. In exercise, ITF is implemented using a policy charge per unit equally a signal of monetary policy and the interbank rate as the operational target. The Inflation Targeting Framework was formally adopted past Bank Indonesia on 1st July 2005, replacing base money as the target of monetary policy.

Based on experience from the Global Financial Crisis in 2008/2009, an of import lesson that emerged was the demand for adequate primal bank flexibility in response to more complex economic developments and a stronger financial sector influence on macroeconomic stability. Consequently, Bank Indonesia strengthened the ITF framework through its evolution into Flexible ITF.

What is Flexible ITF?

Flexible ITF was adult effectually the cadre elements of the existing Inflation Targeting Framework (ITF), including a publicly announced inflation target and forwards-looking monetary policy, namely monetary policy oriented towards achieving the inflation target in future periods due to the time lag effect of monetary policy.

Public accountability of budgetary policy remains an inherent element of Flexible ITF. Flexible ITF was adult based on the following five core elements:

- Aggrandizement targeting as the primal strategy of budgetary policy.

- Integration of monetary and macroprudential policies to strengthen policy transmission and maintain macroeconomic stability.

- The role of commutation charge per unit and capital flow policies to support macroeconomic stability.

- Strengthening policy coordination betwixt Depository financial institution Indonesia and the Regime to control inflation as well equally maintain monetary and financial system stability.

- Strengthening the policy advice strategy as a policy instrument.

Why Flexible ITF?

The Global Financial Crisis that occurred in 2008-2009 forced central banks to rescue the economy and maintain financial system stability. Furthermore, policies that focused solely on ITF implementation were no longer considered sufficient due to the narrow monetary policy mandate of maintaining inflation in line with the target corridor, which was insufficient to maintain overall economic system stability.

The function of the financial arrangement in the economic system is increasing, with the impact of financial organization instability becoming more meaning. This is reflected in the massive recovery costs and far-reaching impact of the Global Financial Crisis in 2008/2009. Such conditions raised awareness of the disquisitional central bank part to maintain fiscal organization stability. Consequently, ITF implementation to maintain price stability was necessary but non sufficient.

After the Global Financial Crunch, even so, growing demand emerged for central banks to strengthen financial system stability in society to ensure macroeconomic and fiscal sector stability. To that end, successful ITF implementation required support of a macroprudential regulatory framework. Therefore, Bank Republic of indonesia evolved ITF into Flexible ITF by strengthening its mandate to maintain price stability and support financial system stability.

How is Flexible ITF Applied?

The overriding objective of ITF and Flexible ITF are the same, namely to command inflation. Still, a nascent dimension that emerged from the Global Financial Crisis was the central bank'southward integrated role to maintain financial arrangement stability, while achieving the price stability mandate. The embodiment of Flexible ITF is the flexibility to integrate budgetary and financial system stability through a policy mix of monetary, macroprudential, exchange rate and capital flow instruments, while strengthening the institutional arrangements in order to optimise the part of policy coordination and communication.

In accordance with the inflation targeting strategy, Depository financial institution Indonesia announces the aggrandizement target for a specific time to come period. The inflation target is set by the Government in coordination with Bank Indonesia for the upcoming three years through a Minister of Finance Regulation (PMK). Bank Republic of indonesia regularly evaluates whether the inflation projections remain in line with the target corridor set. The projections are based on several models and the diverse information available that draw inflation atmospheric condition moving frontward every bit the ground for the monetary policies instituted. This is due to the implications of the time lag effect of monetary policy, with the budgetary policy target thus based on future aggrandizement projections. Efforts to reach the target are implemented through a policy mix response based on transparency and accountability.

Bank Indonesia regularly reports the implementation of its duties to the People's Representative Council (DPR) and besides the Government. Furthermore, Bank Indonesia as well routinely publishes assessments of the latest inflation atmospheric condition and outlook moving forwards, the decisions taken also as future policy direction to maintain aggrandizement in line with the target (forward guidance). This is not merely done under the auspices of transparency, withal likewise an important aspect of strengthening Bank Republic of indonesia brownie to ensure policy effectiveness.

To strengthen the effectiveness of monetary policy transmission, Banking company Indonesia set the BI 7-24-hour interval (Reverse) Repo Rate every bit the policy rate on 19th August 2016, representing the monetary policy response signal in terms of decision-making aggrandizement in line with the target corridor. Apply of BI7DRR equally the reference rate is part of Bank Indonesia'due south budgetary policy reformulation.

Previously, Bank Republic of indonesia had used the BI Rate every bit the reference charge per unit, equivalent to a 12-calendar month interest rate in the term structure of monetary operations. Through the BI7DRR, even so, the tenor of the monetary instrument was shortened to 7 days, which is expected to accelerate monetary policy manual and steer inflation towards the target corridor.

There were three main objectives of monetary policy reformulation. Commencement, strengthening the signal of monetary policy direction. Second, strengthening monetary policy transmission effectiveness through its impact on interest rate movements in the money market and cyberbanking manufacture. Tertiary, accelerating financial market place deepening, particularly in terms of transactions and formation of the interest rate structure in the interbank money market for tenors of 3-12 months.

In do, monetary policy reformulation upholds 4 salient principles. Beginning, reformulation does not modify the monetary policy framework as Bank Indonesia continues to apply flexible ITF. Second, reformulation does non modify the current monetary policy stance. Tertiary, reformulation ensures the policy rate is reflected in budgetary instruments and is transactable with Bank Indonesia. Fourth, determination of the operational target based on various considerations can exist influenced by the policy charge per unit. Consequent with the second principle, reformulation does non modify the electric current monetary policy stance because both the BI Rate and BI7DRR are role of the same term structure with regards to guiding inflation towards the respective target.

The implementation of Flexible ITF besides aims to reach financial organization stability. To that end, Flexible ITF implementation is supported past the application of macroprudential policy. Macroprudential policy focuses on the interactions between fiscal institutions, markets, infrastructures and the broader economy, including measurement of future potential chance. Such policy aims to prevent systemic adventure that could trigger a fiscal arrangement crisis due to macroeconomic weather condition. An in-depth explanation of macroprudential policy is bachelor at the post-obit link: (Link ke kebijakan makroprudensial).

Flexible ITF implementation is also supported by commutation charge per unit policy. Bank Republic of indonesia institutes exchange rate policy in order to manage rupiah exchange rates in line with the currency'southward fundamental value and market mechanisms. Furthermore, exchange rate policy aims to reduce shocks that emerge from a need and supply mismatch in the strange substitution market through selling intervention in the spot market, Domestic Non-Deliverable Forwards (DNDF) market an FX futures market besides as through purchases of tradeable government securities (SBN) in the secondary market place. This strategy simultaneously maintains exchange rate stability an acceptable rupiah liquidity.

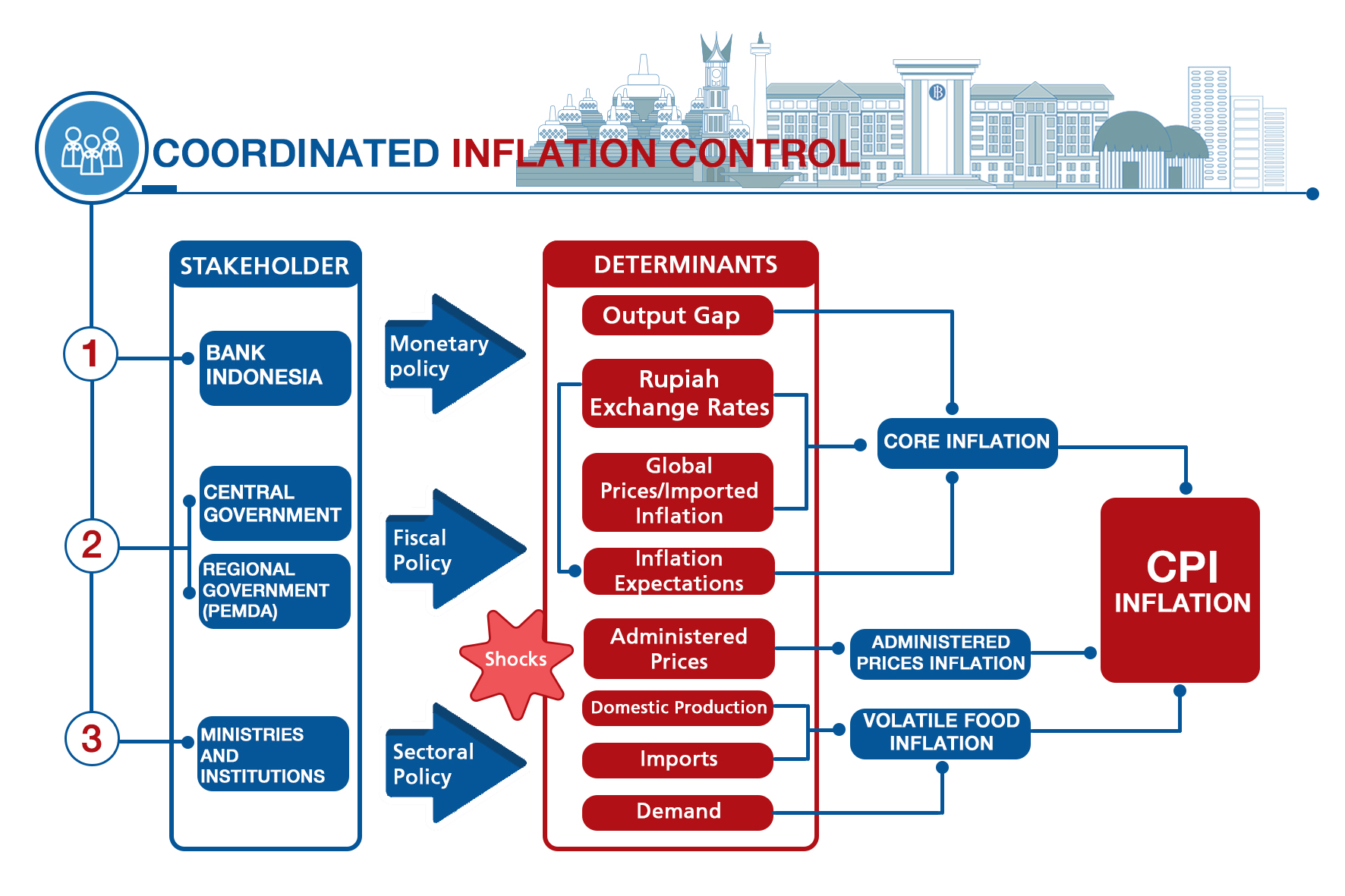

The various aforementioned policies are strengthened through policy coordination with the Government, especially on the supply side. Government policy is predominantly oriented towards maintaining affordable prices, uninterrupted supply and distribution every bit well as effective communication in society to stabilise food prices and command inflation. Policy coordination betwixt Banking company Indonesia and the Government to control inflation has been strengthened through the establishment of a National and Regional Inflation Job Forces (TPI). In addition, policy coordination also reinforces financial organisation stability. Through the Fiscal Organization Stability Commission, Banking company Indonesia in conjunction with the Ministry of Finance, Indonesian Financial Services Authorization (OJK) and Deposit Insurance Corporation (LPS) decide which coordination measures are necessary and provide recommendations in terms of monitoring and maintaining financial arrangement stability.

The overriding objective of monetary policy is to create and maintain rupiah stability, as reflected by low and stable aggrandizement. To that end, Banking company Indonesia sets the BI seven-Mean solar day (Reverse) Repo Charge per unit as the primary policy instrument that influences economic activity, with inflation every bit the ultimate goal. The process of setting the BI7DRR to achieving the aggrandizement target is transmitted through diverse channels with a time lag.

Adjusting the BI7DRR to influence aggrandizement is known every bit the monetary policy transmission machinery. This mechanism shows how Bank Indonesia policy, through adjustments to budgetary instruments and the operational target, influences various economical and financial variables before ultimately affecting aggrandizement. The mechanism works through interactions betwixt the key bank, cyberbanking industry and financial sector, also equally the existent sector. Adjustments to the BI7DRR influence aggrandizement through various channels, including the interest charge per unit channel, credit channel, exchange rate channel, nugget cost aqueduct and expectations channel..

In terms of the interest charge per unit channel, adjustments to the BI7DRR influence deposit rates and lending rates in the cyberbanking industry. Bank Indonesia can apply tight-bias budgetary policy by raising interest rates, which impacts aggregate demand and alleviates inflationary pressures. In contrast, reducing the BI7DRR will lower lending rates thus increasing corporate and household demand for loans. In addition, lower lending rates as well reduce the cost of uppercase for investment in the corporate sector, thus stoking consumption and investment activity and stimulating the economy..

Adjustments to the BI7DRR can also influence the exchange charge per unit through the substitution charge per unit aqueduct. A hike in the BI7DRR, for instance, would increase the differential between interest rates in Republic of indonesia and other countries. A wider interest rate differential would attract non-resident investors to place capital in financial instruments in Republic of indonesia seeking a higher rate of return. In turn, the foreign capital inflow would trigger rupiah appreciation, leading to cheaper imports and more expensive, or less competitive, exports from Indonesia, thus stimulating college imports while simultaneously reducing exports. Consequently, rupiah appreciation would ease inflationary pressures.

The bear upon of changes in involvement rates on economic activity also influences public inflation expectations through the expectations aqueduct. Lower interest rates stimulate economic activity an increment inflation, with workers thus anticipating higher inflation and, hence, demanding higher wages. Producers afterward pass on the cost of higher wages to consumers by raising prices.

The budgetary policy transmission mechanism is characterised past a variable fourth dimension lag. The time lag associated with each manual channel is different. Under normal conditions, the cyberbanking industry will respond to increases/decreases in the BI7DRR past raising/lowering interest rates. All the same, if the banking industry detects higher hazard in the economy, the response to a downward BI7DRR movement is slower. In addition, in the instance of banking industry consolidation to increase capital letter, lower lending rates and increasing demand for loans do not necessarily increase bank lending in response. On the demand side, consumers may not necessarily respond to lower lending rates in the banking industry through higher demand for loans if the economical outlook is weak. Therefore, the effectiveness of monetary policy manual is afflicted past external atmospheric condition, the financial sector and banking industry, besides equally the real sector.

Transparency and Communication

In accord with Deed No. 23 of 1999 concerning Bank Indonesia, as amended by Human action No. three of 2004 and Act No. 6 of 2009, Article 4, Paragraph 2 states that Bank Indonesia is an independent institution, gratuitous from regime and third-party interference, unless explicitly stipulated in prevailing laws and regulations. Institutional independence is counterbalanced confronting transparency and accountability.

Transparency

The principles underlying monetary policy transparency ensure that the information communicated allows the public to understand and anticipate the decisions taken by the central bank to reach the overriding objective. Therefore, the purview of information communicated to the public is every bit follows:

- Objective

The cardinal bank explicitly and consistently communicates what is to exist achieved by monetary policy in terms of the overriding and short-term objectives, as well as the rationale behind those objectives. - Method

Central bank transparency in relation to procedural activities in monetary policy, including communicating the monetary operations undertaken, the results of economic modelling and projections as well as the basic assumptions used, in guild to form expectations in the fiscal markets as well as preclude and minimise market place shocks. In improver, this is required to enhance public understanding of the fundamental banking company's budgetary policy. - Decision Making

The central depository financial institution announces the policies taken along with the underlying considerations, such as a decision to raise the policy rate, immediately later the conclusion has been fabricated.

In addition, the scope of transparency in monetary policy is also contained within the "Code of Good Practices on Transparency in Monetary and Financial Policies", which has been developed past the International Monetary Fund (IMF) since 1999 and is currently applied past many of its members. The Code contains a number of key adept practices as follows:

- Clarity of roles, responsibilities and objectives of the budgetary policy authority;

- Open process for formulating and reporting monetary policy decisions;

- Public availability of information on monetary policy; and

- Accountability and assurances of integrity past the monetary potency.

Monetary Policy Communication

Monetary policy effectiveness can be improved through effective communication, peculiarly during periods of heightened dubiety. Every bit the monetary authorisation, Bank Republic of indonesia simply has straight influence over short-term interest rates, while long-term interest rates are adamant more by future expectations of monetary policy, which can be directed through policy communication.

Communication contributes to stronger transparency and accountability at Banking company Indonesia by providing greater public agreement in terms of monetary policy in general, while forming public and market expectations as well every bit reducing future uncertainty. Bank Indonesia conducts monetary policy communication through diverse media equally follows:

- Press Releases and Press Conferences;

- Publications, including the Budgetary Policy Study, Monetary Policy Review, Economical Report on Indonesia, Quarterly DPR Report and then on;

- Bank Indonesia website as well as various digital and social media platforms;

- Talk shows aired on radio and television set;

- Seminars and discussions with stakeholders; and

- Regional dissemination.

Accountability

Act No. 23 of 1999 apropos Bank Indonesia, as amended by Human action No. iii of 2004 (as amended by Act No. vi of 2009), mandates accountability at Bank Republic of indonesia in the implementation of duties, responsibilities and budget.

PThe principles of accountability in terms of implementing Bank Indonesia's duties and responsibilities are applied through the direct public communication of information via the mass media at the beginning of each year concerning an evaluation of budgetary policy implementation in the previous year besides every bit the budgetary policy direction and targets for the upcoming year. Furthermore, such information is as well communicated in writing to the President and People's Representative Council (DPR) of the Republic of Republic of indonesia.

Accountability also closely relates to independence. More than independence enjoyed by a central bank demands greater accountability.

Low and stable inflation are prerequisites for public prosperity in line with the macro policy goals. Even so, sources of inflationary pressures not only originate from the demand side, which tin can be managed by Bank Indonesia, simply besides stalk from the supply side in relation to the product and distribution of goods. In addition, inflation shocks may too emerge due to government policy concerning administered prices, such as fuel and other energy prices. Therefore, a policy mix is required in order to achieve depression and stable inflation.

Depository financial institution Indonesia coordinates with the central and local government to control inflation. Meanwhile, the Government also plays a office in terms of controlling inflation expectations and managing supply through the management of supply, distribution, connectivity, trade chain and subsidies. Synergy is formed to control inflation within the predetermined target corridor through the institution of inflation job forces. A primal inflation job strength (TPI) was established in 2005, with regional inflation task forces subsequently formed since 2008.

Coordinated inflation control was strengthened through Presidential Regulation (Perpres) No. 23 of 2017 concerning the National Inflation Chore Force (TPIN) as a legal foundation. The Presidential Regulation stipulated the coordination mechanism for inflation control through the formation of a Central Inflation Chore Force (TPIP), every bit well as Regional Aggrandizement Task Forces (TPID) at the provincial and city/regency level.

The legal foundation was subsequently bolstered past a promulgation of Analogous Minister of Finance Regulation No. x of 2017 concerning the Mechanisms and Procedures for TPIP, Provincial TPID and City/Regency TPID, Analogous Government minister of Finance Regulation No. 148 of 2017 apropos the Duties and Membership of Working Groups and TPIP Secretariat, and Minister of Dwelling house Diplomacy Prescript No. 500.05-8135 of 2017 concerning the Regional Aggrandizement Job Forces (TPID). The inflation command program focuses on 4K principles every bit follows:

- Affordable prices.

- Available supply.

- Uninterrupted distribution.

- Effective communication.

Source: https://www.bi.go.id/en/fungsi-utama/moneter/default.aspx

0 Response to "The Economy Is Doing So Good We Haft to Lower Intrest Rates Again ?"

Post a Comment